*6/7/25 – Victorias Secret has changed its earnings date from June 5th to June 11th.*

I’ve said before how while I think technical analysis and fundamentals are obviously important when considering an investment, some of the best trade ideas I’ve had came to me while living my every day life, just doing what I am already doing (highly recommend taking walks!), most recently when I was on a work trip to Miami in April and noticed a Victoria’s Secret store opening in the area on Lincoln Road (everything starts with an idea!). This had me not only bullish but also a bit nostalgic. The price was around 17 at the time and it ran all the way to 23, albeit rejected at that level about now sitting around 20 in the end of May, I still think this has room to go higher.

My favorite trade right now is $VSCO. Opening new locations, earnings positive YOY, and BBRC International (a billionaire named Brett Blundy) filed a 13D/A on April 1st increasing their position over 1 million shares pic.twitter.com/NsAs9XqVa4

— agent bubblegum (@kaitduffy) April 22, 2025

I grew up in the early 2000s when VS peaked, so to watch its decline in real time did give make me feel some type of way, but in an effort to rebrand and turn around the earnings the company has shown great promise to get us back in the millennium turning vibe in 2025.

Seeing brands like Abercrombie & Fitch reporting good numbers along with companies like GAP also beating analyst consensus this past quarter, I do have hope for the company reporting better than expected revenue and beating EPS this coming report on June 5th.

Victoria’s Secret is a staple after all in the industry, and I mean let’s be honest: who hasn’t stopped in and bought a 5 for $30 at least once in the last year? I have to be honest here, I have, in addition to a bra that was on sale for their famous semi-annual sale which occurs 2x per year in the summer and holiday season.

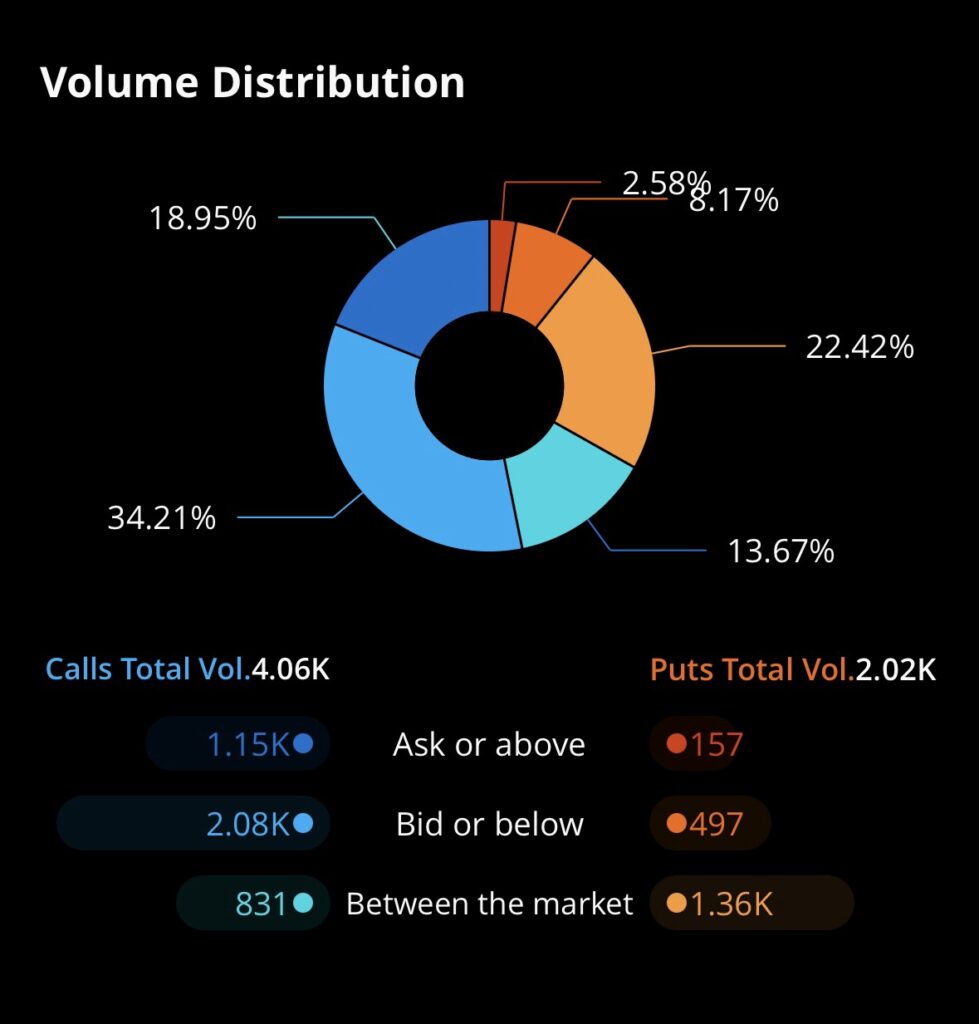

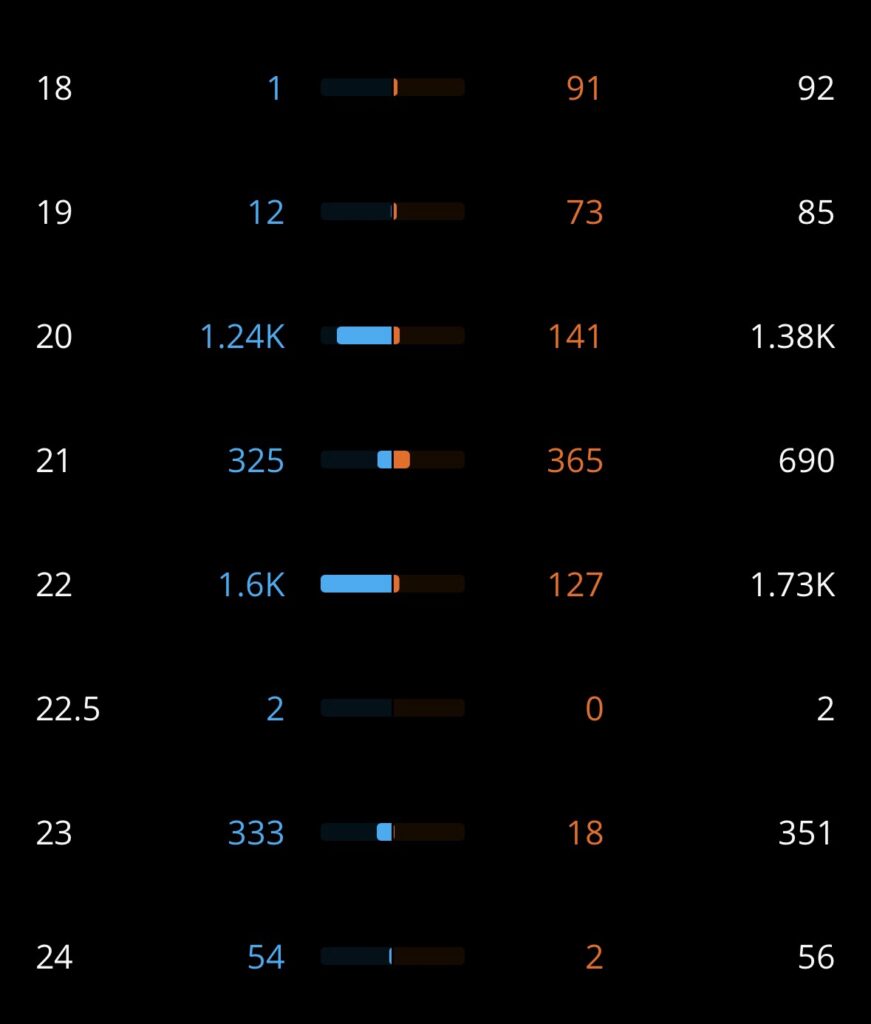

Let’s take a look at the options data:

Calls Total Vol: 4.06k

Puts Total Vol: 2.02k

Options Vol Analysis (via Webull):

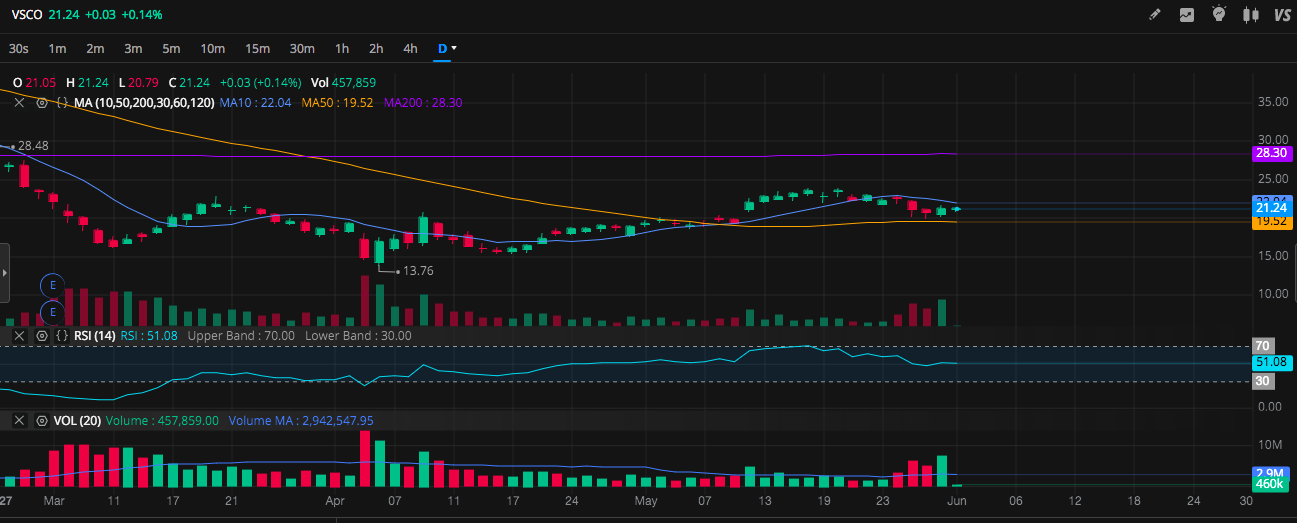

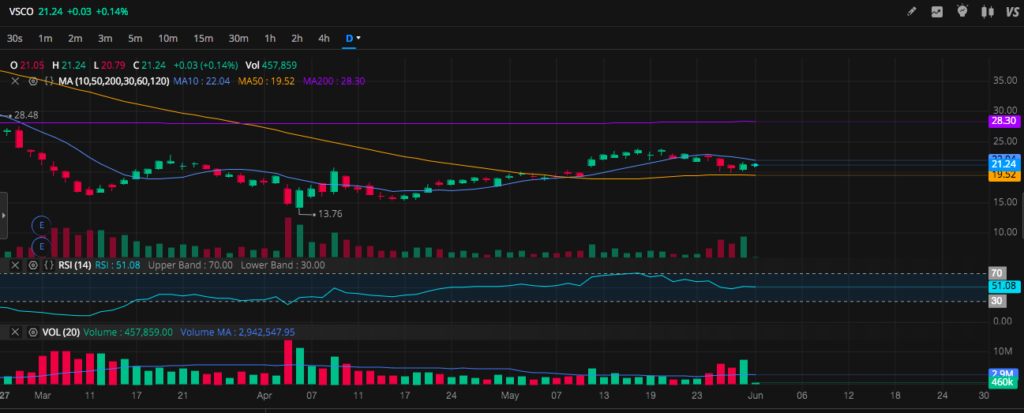

VSCO Daily Chart says if it stays above 19.52 it can get back above 21 and hopefully try and breakout towards the 200DMA. Bearish case would be falling below 19.50 and losing a main support above the 50DMA.

If I had to make a guess I am leaning towards VSCO breaking into the upside, but the numbers will have to be really good for the report. According to Tip Ranks on May 29th, the call Volume was “above normal,” which doesn’t hurt the bull case.

The institutional ownership has remained steady with a drop in the summer of ’24; now since December of last year there was a slight uptick plateauing potentially for a next leg up if the earnings come in hot.