In the beginning of the year I wrote about how in 2025 I was sticking with my trades VS trying to time the market (I’ve admitted before that my execution is slightly less than terrible). Besides, what does the Average Joe know more than I at this point? Almost 5 years into the game and it feels like things are finally clicking: buy and hold. Take profits. Rinse, repeat. But wait: is it really that easy? And am I actually missing out on the day-to-day intraday action if I actually sit there and try, VS giving up after 10 minutes of frustration? Or is it all meaningless, this so-called “TA”? Either way, I’m here to stay for the love of the game.

A lot of people were bearish in the beginning of the year, even banks were lowering their annual SPX targets (womp, womp!), but there was at least ONE bull left standing back in March who saw light at the end of the tunnel: yes, I was not falling victim to the media or the “rising bear wedge” that was gaining traction online. All of my signals (10DMA cross being the main indicator) were leaning bullish.

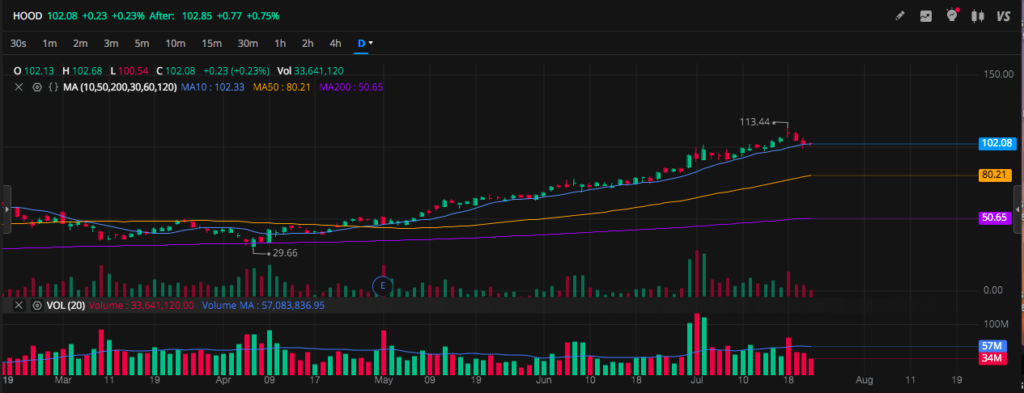

My biggest call of 2025 so far was definitely Robinhood. Everything was aligned for the perfect setup including the famous cup and handle breakout pattern on the macro. What a beautiful trade! If you bought the $67C it went from 4.40 all the way to almost 40.00 if not higher if you held any runners into 7/18 expiration–honestly nothing short of an ideal situation for a TA trader buying on that trigger level.

Taking a look at the names I’ve been watching with some new ones to the list, here are my top watches into August and into Q3 for what I think could be some great trades:

HIMS

HIMS shareholders have a special type of resilience that only certain stock traders can relate to: with a wild ride from the $72 ATH in the beginning of the year, it seems shorts have been devouring the bulls on and off struggling to get back above $60. However today’s candle on 7/23 with a gap fill and a very bullish candle with higher than average volume over the last three days. Now the true test will be breaking the previous resistance from the gap fill which is above $65.

SOFI

I guess I’ve been paying attention to HOOD so much that I forgot all about SOFI. So it goes! But looking at this clean bullish chart with a bounce off the 10DMA today, I’d be willing to bet this will be trading back to $22 especially if the other “memes” can pull through as sentiment. There is also on the monthly macro chart a cup and handle shape pattern that could go just like Robinhood if it breaks $24, so be on the lookout for that level to break for the big run to start to get back to 2021 levels.

HOOD

Wow, what a banger! And now that I’m comparing the two, very similar to SOFI. HOOD ideally could get back over its 10DMA which it has shown resilience to YTD since April, or it could go bearish and see the 50DMA again for a test to $80. I am leaning toward a bullish move as this stock has been unstoppable; and besides the TA, I absolutely love the company and look forward to their evolution in an ever-changing market encouraging newbies to invest.

CAVA

Oh boy. If I had to pick *one* out of all of them, CAVA setup is looking quite primed for a move to its 200DMA *IF* it can hold the new 10DMA which just crossed over the 50 which is a very bullish signal. If it can get back above this level I do think that there could be a move back to $100-110. CAVA has a debt-free company just like HIMS, so these two are not only growing at a fast pace, but also saving a lot of cash in the meantime which is very bullish. I actually tried to go yesterday to get a video, but the crowds and line were too long for me to even pop in (bullish!).

SG

True story: I know a lawyer who eats Sweetgreen every day and is all-in on the stock; literally his entire life is law and salads on repeat. Anyways, I should text him, because it looks like the stock had its 10DMA crossover officially today with some bullish volume, mimicking similar setups from March/April that ended up running hard. Currently SG is 18% short via Fintel with only 117M shares outstanding and 102M free float, so will be volatile. If it can get back above the resistance from May around $20, I do believe this could be trading back to the 200DMA by fall at the very least.

VSCO

I wrote about Victoria’s Secret and how excited I was about this name back in April while on vacation in Miami (maybe there’s something to be said about taking a little break and getting inspired for your trades!). It did end up running hard and then failed to break the $22-24 level, so now I’d be looking at this price as the main resistance (at about $26.50 now). Bearish below the 10DMA roughly $20.

NVO

I think Novo Nordisk is great. Obviously something happened with the Hims and Hers deal, and as a person who has had many, many instances where a deal blew up, well, let’s just say there have been more than a few times. So when everyone is getting riled up you need to look at the facts without getting emotional. I look at it this way: HIMS and NVO both ended up getting exposure, as they say “all PR is good PR” or whatever. In hindsight, I did not even know about NVO until less than six months ago, and now it’s on my watch list!

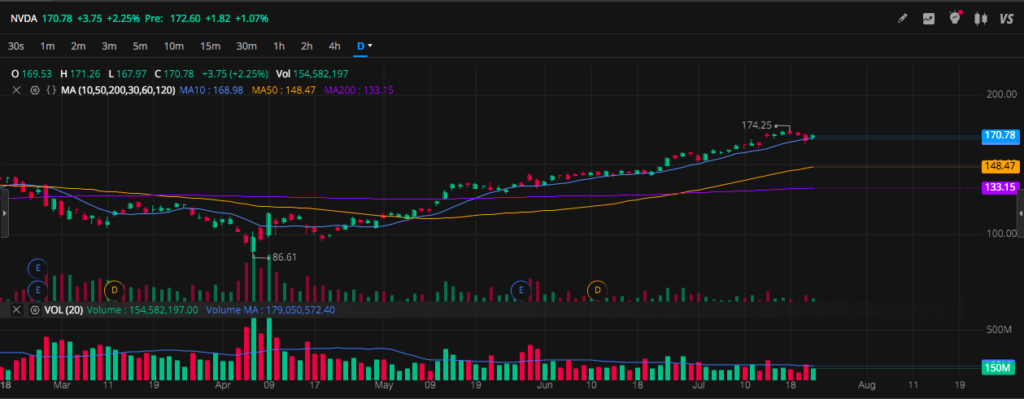

NVDA

Another gorgeous chart that shocked the world yet again: Nvidia with the clean bullish run off a double bottom back in April. Not sure if anyone remembers (pre-split) when the stock was breaking $400 for the first time and ran all the way to $900-1000, but this momentum is giving me the feeling that this could be running to $200. YES, that would mean Nvidia would be a $4.88 trillion company! No big deal or anything.

PYPL

I have this thing with PYPL, I can’t explain it, but this ascending wedge / triangle from April kissing the 200DMA has me thinking PayPal might finally have its big moment. They have significantly stepped up their marketing game, and this is an app I actually use. Watch for a break above the main resistance $82 to see a gap fill to $86.