As a millennial who grew up loitering in food courts and flipping through racks at the mall, I’ve got a soft spot for these names: American Eagle Outfitters (AEO), Victoria’s Secret (VSCO), Kohl’s (KSS), Gap (GAP), and Abercrombie & Fitch (ANF). These brands are pulling a phoenix move, rising from the ashes of retail struggles with a vibe that’s got investors buzzing. Let’s unpack the latest market moves, why these stocks are rebounding, and why I’m particularly stoked about Victoria’s Secret—complete with a tongue-in-cheek wish for their next big marketing campaign.

The Millennial Rebound: Why These Brands Are Hot Again

If you’ve been tracking the retail sector, you’ve probably noticed that these legacy mall brands are shaking off the dust. It’s like they’ve cracked the code on appealing to millennials and Gen Z, who are apparently still shopping for baggy jeans, cozy loungewear, and that perfect Instagram-worthy outfit. The market’s been kind to these names lately, and it’s not just nostalgia driving the surge—it’s strategic pivots, digital gains, and a knack for staying relevant in a TikTok-driven world.

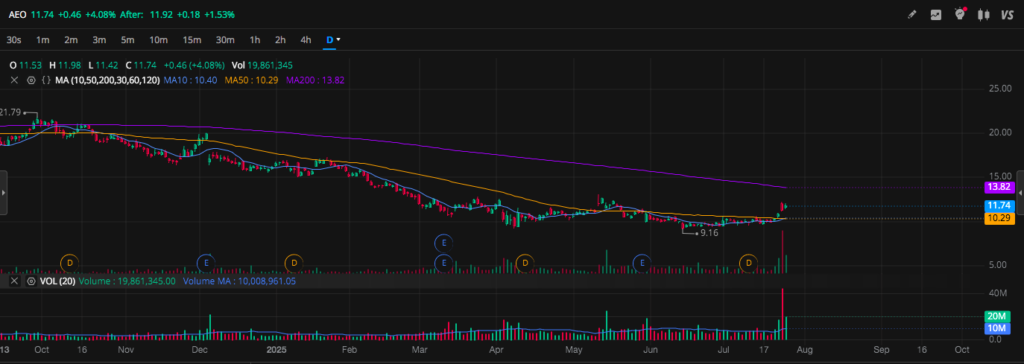

American Eagle Outfitters (AEO) is a great place to start. As of July 23, 2025, AEO’s stock price is sitting at $10.82, with a market cap of $1.77 billion. Sounds modest, but don’t sleep on them. AEO’s been leaning hard into their Aerie brand, which is killing it with body-positive intimates and activewear. Their focus on digital channels and sustainability (think eco-friendly manufacturing) is resonating with younger shoppers. However, they hit a rough patch in Q1 2025, with a $75 million merchandise write-down and a 5% revenue drop, leading to a pulled full-year guidance due to “macroeconomic uncertainty.” The stock took a 7% hit after that news, but I think it’s a temporary blip. AEO’s remodeling stores (56 in 2024, aiming for 90–100 in 2025) and reducing China sourcing to dodge tariffs show they’re playing the long game. I’m optimistic they’ll bounce back as spring picks up.

Kohl’s (KSS) is another name that’s been quietly grinding. They’ve been in the news for weaker holiday forecasts back in 2023, but recent moves suggest they’re adapting. Kohl’s is doubling down on partnerships (like with Sephora) and pushing private-label brands to capture value-conscious shoppers. Their stock’s been volatile, but the market’s rewarding their efforts to modernize stores and boost e-commerce. It’s not a screaming buy, but it’s a steady player in this rebound narrative.

Gap (GAP) is the comeback kid we didn’t see coming. They’ve been capitalizing on casual wear trends, with their Old Navy brand leading the charge. Gap’s stock has benefited from strong demand for comfy, affordable styles, and their Q4 2024 sales guidance was raised, signaling confidence in holiday performance. Their focus on fresh inventory and lean supply chains is paying off, keeping them ahead of the curve in a choppy retail environment.

Abercrombie & Fitch (ANF) is the glow-up of the decade. Once the poster child for preppy exclusivity, they’ve reinvented themselves with inclusive sizing and trendy fits like baggy pants and viral sweatshirts. Their Q4 2024 sales guidance was bumped to high teens growth, and they’re seeing traction with Black consumers thanks to collabs like the one with Harlem’s Fashion Row. That said, they cut profit guidance due to tariff concerns, and their stock’s down 47.49% year-to-date as of May 2025. Still, their brand strength and digital push make them a standout in this group.

Why I’m Most Bullish on Victoria’s Secret

Now, let’s talk about my favorite: Victoria’s Secret (VSCO). I’m straight-up bullish on this one, and here’s why. VSCO has been on a mission to shed its outdated image, embracing inclusivity and modernizing its brand. They’re not just selling lingerie anymore—they’re pushing swim, activewear, and cozy loungewear that’s resonating with millennials and Gen Z. Their digital sales are growing, and they’re optimizing their store footprint to focus on high-traffic locations. The market’s been rewarding their pivot, with VSCO often mentioned alongside AEO and ANF in retail comparisons.

But it’s not just the numbers. Victoria’s Secret is nailing the cultural zeitgeist. They’ve ditched the overly airbrushed Angels era for a more authentic, diverse vibe, and shoppers are eating it up. Their ability to stay relevant in a crowded market—while competitors like Kohl’s lean on discounts—gives them an edge. I think their stock has room to run, especially if they keep innovating and avoid the tariff traps that are spooking other retailers.

And okay, here’s my wild, half-joking pitch: Victoria’s Secret needs to go all-in on a blockbuster ad campaign featuring Kylie Jenner. Picture this—Kylie strutting in their latest swim collection, breaking the internet with a TikTok-first campaign that goes viral overnight. Sure, it might cost them a fortune (like, let’s be real, they’d probably go into significant debt to afford her), but the buzz would be unreal. Kylie’s got that millennial-to-Gen-Z crossover appeal, and her influence could skyrocket VSCO’s brand visibility. I’m chuckling as I write this, but honestly, it’s not the worst idea—VSCO needs to keep pushing bold, attention-grabbing moves to stay ahead.

The Bigger Picture

This millennial rebound isn’t just about these five brands—it’s about retail’s ability to adapt in a tough economy. Tariffs, inflation, and cautious consumers are real hurdles, but AEO, Kohl’s, Gap, ANF, and VSCO are proving they can hang. They’re leaning into digital, nailing trend-driven inventory, and remodeling stores to stay fresh. Abercrombie and Gap are killing it with new styles, AEO’s Aerie is a bright spot despite their Q1 stumble, and Kohl’s is holding steady with strategic partnerships. But Victoria’s Secret? They’re my top pick for capturing the cultural shift and driving growth.

So, there you have it—my take on the mall brand revival. I’m keeping my eyes on these stocks, especially VSCO, and maybe, just maybe, daydreaming about Kylie Jenner in their next campaign. What do you think—am I onto something, or is my Kylie idea a total pipe dream?

Note: All stock prices and market data are accurate as of July 23, 2025, based on available information. Always do your own research before investing!