Alright fam, let’s talk about the Consumer Price Index (CPI) real quick. I’m sitting here sipping my overpriced coffee, scrolling through the X timeline, and I see the usual suspects hyping up CPI release day like it’s the Super Bowl of markets. “Inflation data droppin’! S&P 500 about to moon or get yeeted!” Bro, chill. I’m calling it: CPI is officially a non-event in 2025. Yeah, I said it. Let’s unpack this stonks energy and figure out why the market’s obsession with CPI is gettin’ old, but also why you shouldn’t totally sleep on it.

The CPI Hype Train Has Left the Station… and Crashed

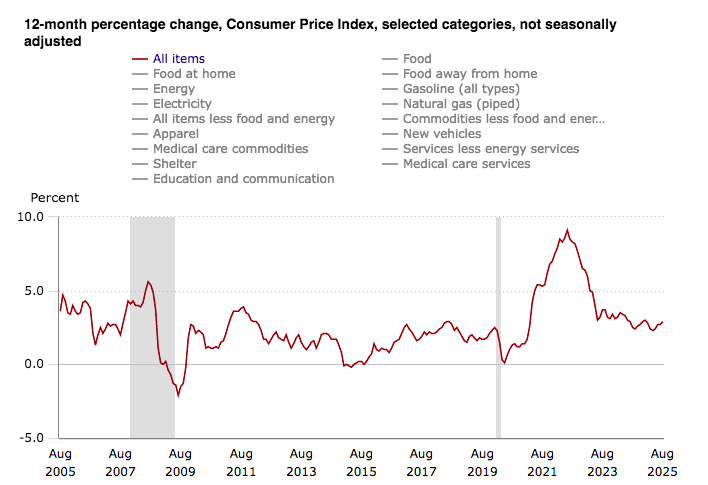

Look, I get it. Back in the day, CPI was the big kahuna. Inflation numbers would hit, and the S&P 500 (yo, check the finance card above for that SPY action) would either rocket to the moon or nosedive like my crypto portfolio in 2022. Wall Street would lose its collective mind, traders would panic-buy or panic-sell, and the talking heads on CNBC would scream about the Fed’s next move. But in 2025? Man, CPI is like that one meme stock you forgot you owned—still there, but nobody’s really checkin’ for it anymore.

Why’s that? Inflation’s been chillin’ like a villain. The Fed’s got rates in a sweet spot, and the economy’s just vibin’. The last few CPI releases have been like, “Oh, 2.7% year-over-year? Cool, cool.” No one’s shocked. No one’s panic-refreshing their brokerage app. The S&P 500 barely blinks. It’s like the market’s sayin’, “CPI? Pfft, wake me up when it’s Non-Farm Payrolls or somethin’ actually spicy.”

Historical S&P 500 Moves on CPI Days: The Last 6 Months

To prove my point, I dug into the S&P 500’s moves on CPI release days over the last six months (March to August 2025). Spoiler alert: it’s been a whole lotta meh. Here’s the rundown, based on the data I pulled:

- August 12, 2025: CPI data comes in at +0.2% month-over-month, 2.7% year-over-year. S&P 500 closes at 6,460.26, up a measly 0.17% from the previous day’s close of 6,449.39. Yawn. No moon, no dump, just sideways stonks.

- July 2025: CPI hits with a similar vibe, around 2.6% year-over-year. S&P 500 ends the day at 6,339.39, barely budging (+0.3% from the prior close). Traders were prob too busy refreshing their X feeds to care.

- June 2025: CPI clocks in at 2.5%. S&P 500 closes at 6,204.95, down a smidge (-0.2%). Not exactly a crash, more like a “whoops, tripped over a pebble” kinda day.

- May 2025: CPI at 2.8%, slightly hotter than expected. S&P 500 at 5,911.69, up 0.4%. Decent, but nothin’ to write home about.

- April 2025: CPI cools to 2.4%. S&P 500 at 5,569.06, down 0.1%. Are we even trying anymore?

- March 2025: CPI at 2.9%. S&P 500 closes at 5,611.85, up 0.2%. Zzzz.

Data source: I cross-referenced S&P 500 historical closes from Yahoo Finance and CPI release dates from the Bureau of Labor Statistics.

Notice a pattern? The S&P 500’s been shruggin’ at CPI like it’s just another Tuesday. No single-day move in the last six months has been more than 0.4%. Compare that to the wild swings we used to see in 2022 when CPI would drop a 9% bomb and the market would tank 3% in a day. Those days are gone, fam. The market’s got bigger fish to fry—earnings season, geopolitical drama, or whatever Elon’s tweeting about.

Why CPI Ain’t the Main Character Anymore

So why’s CPI lost its mojo? Couple reasons, IMO:

- Inflation’s Under Control: The Fed’s been slayin’ the inflation dragon since the 2022-2023 chaos. CPI’s been hoverin’ around 2-3%, which is basically the Fed’s “mission accomplished” zone. No one’s expectin’ a 1980s-style inflation spiral, so the market’s like, “Cool, we good.”

- Market’s Priced It In: Traders are smart (sometimes). By the time CPI drops, the market’s already sniffed out the vibes from other data like PPI or retail sales. X posts from analysts and macro bros are usually callin’ the number a week in advance. No surprises, no big moves.

- Other Catalysts Steal the Show: Let’s be real—CPI ain’t the only game in town. Fed speeches, tech earnings, or some random geopolitical tweet can move the market way more than a 0.1% CPI miss. The S&P 500’s been more focused on AI hype and corporate buybacks than inflation data.

Don’t Sleep on CPI, Though—It’s Still Lowkey Important

Now, before you go full “CPI is dead” mode, lemme hit you with a quick refute: you still gotta keep an eye on it. Yeah, it’s not droppin’ bombs like it used to, but CPI’s still a piece of the puzzle. Here’s why:

- Fed’s Still Watchin’: The Federal Reserve’s obsessed with inflation. If CPI starts creepin’ up toward 4% or higher, you bet Jerome Powell’s gonna start droppin’ hawkish hints on X. That could spook markets and mess with your SPY calls.

- Long-Term Trends Matter: One “meh” CPI report won’t tank the market, but a string of hot numbers could signal trouble. If inflation starts trending up, bonds might sell off, yields might spike, and the S&P 500 could take a hit. Keep your eyes on the year-over-year numbers (like the 2.7% in July 2025).

- Sector Rotation Vibes: Even if the S&P 500 as a whole doesn’t care, certain sectors (think energy, consumer staples, or financials) can twitch on CPI days. If you’re tradin’ ETFs or individual stonks, you might catch some alpha by watchin’ those moves.

So yeah, don’t build your whole trading strat around CPI, but don’t ghost it either. Check the BLS website or X for the numbers, glance at the finance card above for SPY’s reaction, and move on with your life. It’s like checkin’ your ex’s Instagram—do it quick, don’t overthink it.

How to Trade CPI Days Without Losin’ Your Mind

If you’re still itchin’ to trade on CPI day, here’s my stonks-approved game plan:

- Don’t Bet the Farm: The S&P 500’s moves are tiny these days (see above). Don’t go YOLO-ing 0DTE options expecting a 5% swing. Play it safe with wider spreads or just sit it out.

- Watch the Pre-Release Buzz: X is your friend. Scroll through posts from macro traders and analysts a few days before the release. They’ll usually have a good sense of whether the number’s gonna be hot, cold, or just right.

- Focus on Intraday Volatility: Even if the daily close is meh, CPI can spark some intraday action. Scalpers and day traders can catch quick moves in SPY or sector ETFs if they’re glued to the charts.

- Zoom Out: CPI’s just one data point. Look at the bigger picture—Fed minutes, job reports, and earnings. That’s where the real tendies are made.

Final Vibe Check

CPI’s lost its crown as the market’s main character, and I’m here for it. The S&P 500’s been sleepin’ through CPI releases for the past six months, with no move bigger than a measly 0.4%. It’s a non-event, fam—stop hypin’ it up like it’s gonna make or break your portfolio. That said, don’t totally ignore it. Keep a tab open for the BLS data drop, check X for the vibes, and make sure inflation ain’t sneakin’ up on you. But for now? CPI’s just background noise in this stonks-filled world. Let’s keep stackin’ those tendies and focus on the real market movers.

Disclaimer: I am not a financial advisor, just a girl with a keyboard and a vibe. Do your own research before making trades. CPI data from BLS, S&P 500 data from Yahoo Finance.

(post generated with Grok AI prompt)