If you’ve been following my ramblings, you know I’m all about those themes that feel like they’re straight out of a sci-fi novel but are actually reshaping our world: electric vehicles zipping silently down the road, massive grid batteries keeping the lights on during peak hours, and yeah, the whole “recycle or bust” vibe to keep Mother Earth from throwing a tantrum. Today, I’m geeking out over the battery boom, specifically, how companies like $ABAT (American Battery Technology) are leading the charge (pun very intended) in extraction, recycling, and sourcing the raw goodies like lithium, cobalt, nickel, and manganese that make it all tick. Buckle up: this is the kind of trade that keeps me up at night, in a good way.

Let’s start with the big picture, because honestly, who doesn’t love a good origin story? We’re in the thick of the EV revolution, and by 2030, projections are screaming that we’ll need batteries equivalent to trillions in value just to keep up with demand. But here’s the chill reality check: mining all that lithium from scratch? It’s messy, energy-hungry, and geopolitically dicey (think: supply chain snarls from far-flung corners of the globe). Enter the heroes of the hour: battery recycling and smart extraction tech. These aren’t just buzzwords; they’re the sustainable sidekicks turning old EV packs into fresh cathode material, slashing waste, and cutting costs by up to 30% on raw inputs. And the natural resources angle? Spot-on. Lithium’s the star, but we can’t forget cobalt (hello, ethical sourcing debates!), nickel for that energy density punch, and manganese to keep things stable. Companies nailing this trifecta (pulling metals from the earth cleanly and looping them back from dead batteries) are the ones I’m eyeing for the long haul.

Speaking of plays that have me hyped, I’ve been riding $AQMS (Aqua Metals) at around $5. These guys are the eco-warriors of recycling, using their AquaRefining™ tech (think electricity-powered extraction, no smelly chemicals or furnaces) to pull black mass from spent batteries and turn it into high-purity lithium and other metals. Q2 2025 updates showed them hitting industry-leading lithium recovery rates, plus they’re stacking MOUs for feedstock and offtakes while eyeing that first full-scale “campus.” Sure, they did a reverse split earlier this year to stay Nasdaq-compliant, and earnings missed estimates last quarter (-$0.07 vs. expected -$0.06), but at this price, it’s screaming value in a sector that’s about to explode. With The Battery Show coming up in October and whispers of JV deals, I see $5 as a sweet entry, potential for a double if recycling mandates kick in harder. Fingers crossed; this one’s got that “early innings” feel.

Look, I’m no hedge fund wizard, just a retail girl who digs sustainable bets that align with the planet (and my portfolio). The battery theme isn’t going anywhere; it’s accelerating. Recycling closes the loop on those precious resources, extraction tech makes new mining less nightmare-ish, and together? They’re the backbone of the energy transition. If you’re dipping your toes in, start small, DYOR, and maybe grab some popcorn for the ride.

Quick Hits: Publicly Traded Plays in the Battery/Recycling/Resources Theme

Here’s a curated list of tickers I’m watching (or nibbling on) for exposure to batteries, recycling, and the metals supply chain. Focused on U.S./global names with real momentum in 2025—mix of pure-plays and diversified giants. Prices approximate as of early October 2025; always check live quotes

ABAT (American Battery Technology): Extraction + recycling focus; up big YTD on revenue jumps.

AQMS (Aqua Metals): Clean recycling tech leader; my current fave with their battery recycling tech

SQM (Sociedad Química y Minera): Massive lithium producer in Chile; recycling tie-ins via partnerships.

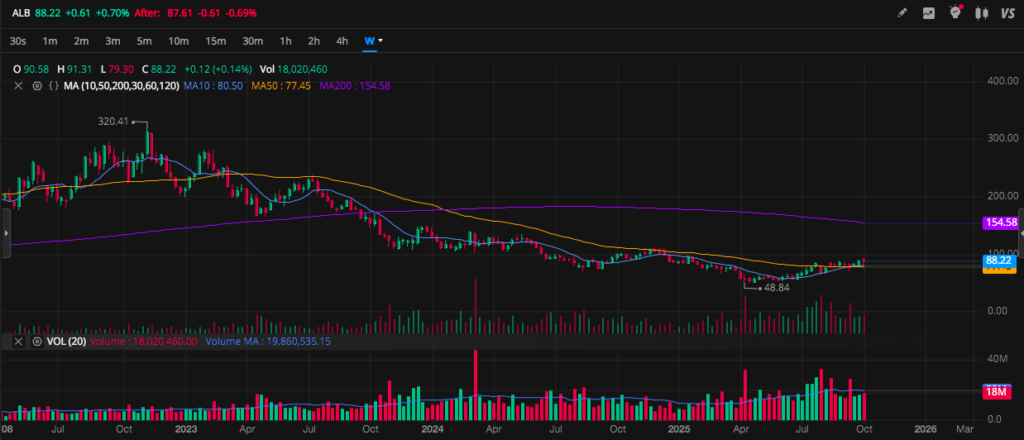

ALB (Albemarle): Global lithium giant with U.S. extraction ops; vertically integrated for batteries.

UMICY (Umicore ADR): Belgian recycling powerhouse; extracts Ni/Co/Li from EV batteries at scale.

GNENY (Ganfeng Lithium ADR): Chinese lithium behemoth with recycling projects in multiple countries.

LAC (Lithium Americas): Thacker Pass project for U.S. lithium; heavy on domestic extraction.

KULR (KULR Technology) for battery tech/thermal management.

LIT (Global X Lithium & Battery Tech ETF): Easy basket play for broad exposure without picking winners.

There you have it, my casual take on why this theme’s got legs (and electrodes). Stay green, stay invested.

—Your Retail Battery Buddy

(post generated with Grok AI)