I love a theme! And even better, I love when a theme just so happens to work with a trade making lots of bullish volume, which is what has been happening with the biotechs lately the last few weeks despite the market turmoils in big tech stocks and those companies reliant on Chinese imports that might be taking a hit soon.

It has been incredible to watch HIMS come into fruition over the last couple of years and gaining even more traction with its weight loss drug plan inclusion. Now, digging a bit deeper off of that due diligence, I bring you a new watchlist of various biotech / pharma companies working on developing their own drug to be put on the market or utilized by one of these bigger companies for an M&A play.

Thanks to AI (shout out, Grok!), I was able to quickly compile a list of companies that are in ongoing phases of various weight loss drug trials and retrieved further data for your analysis including cash on hand, shares outstanding, phase of weight loss drug, and analyst ratings. These plays can be a bit risky with offerings, etc., so it is important in my opinion to know what you are trading, including total market cap and cash on hand so you can detect an offering before it happens.

Viking Therapeutics

Ticker: VKTX

Cash on hand: $903M

Market Cap: $2.78B

Shares Outstanding: 112M

Weight Loss Drug Phase: Phase 3 Incoming Q2 2025

Analyst Rating: Strong Buy 50%, Buy 39%, Hold 11%

VKTX stuck in between the 10+50DMA with a chance to turn really bullish (ALT has a similar setup). Ideally this week can reclaim above $26.85 to see back above $30s. This is a heavily shorted name about 23% according to Fintel so has a chance to really squeeze and make a move.

Structure Therapeutics

Ticker: GPCR

Cash on hand: $915M

Market Cap: $1.37B

Shares Outstanding: 57M

Weight Loss Drug Phase: Phase 2

Analyst Rating: Strong Buy 50%, Buy 50%

GPCR had some unusually bullish volume not too long ago on 4/17, followed by another bullish day on 4/18, now with an official 10DMA crossover as of 4/24 which has me incredibly bullish at the moment. Ideally it can get back above its 200DMA $31.50 if it can pass its 1 month resistance $25.50.

Altimmune

Ticker: ALT

Cash on hand: $131M

Market Cap: $384M

Shares Outstanding: 77M

Weight Loss Drug Phase: Phase 2-3

Analyst Rating: Strong Buy 56%, Buy 33%, Hold 11%

ALT has a potential to become bullish again if it can reclaim its 50DMA $5.38. In addition, ideally its 10DMA can crossover the 50DMA respectively. Very bullish above $5.40-6.

Zealand Pharmaceuticals

Ticker: ZLDPF

Cash on hand: $1.3B

Market Cap: $4.56B

Shares Outstanding: 70M

Weight Loss Drug Phase: Phase 3

Analyst Rating: N/A

I don’t love OTC stocks and this chart actually does not look great to me, but if you are looking into it I would need a close above $68 to get bullish again on this name.

Novo Nordisk

Ticker: NVO

Cash on hand: $15.65B

Market Cap: $211B

Shares Outstanding: 3B

Weight Loss Drug Phase: Phase 3 (2 different drugs)

Analyst Rating: Strong Buy 38%, Hold 33%, Buy 17%, Sell 8%

NVO had some nice bullish volume the last 10 trading sessions or so minus on 4/23; it has shown bullish signs trading and closing above its 10DMA the last 3 sessions which has me leaning towards a move back to $73 if it can close above the previous resistance at about $67.

Eli Lilly

Ticker: LLY

Cash on hand: $2.8B

Market Cap: $827B

Shares Outstanding: 947M

Weight Loss Drug Phase: Phase 3 (2 different drugs)

Analyst Rating: Strong Buy 59%, Buy 28%, Hold 10%

LLY is a beast and extremely volatile; its recent moves from that bottom $677 all the way to $874–well, let’s just say you had to have timed it, but what an incredible jump. Now it’s showing bullishness with a 10DMA crossover potential in addition to trading above its 10, 50, and 200DMA respectively. Leaning bullish back to $900s.

Amgen Inc

Ticker: AMGN

Cash on hand: $9B

Market Cap: $152B

Shares Outstanding: 537M

Weight Loss Drug Phase: Phase 2-3

Analyst Rating: Hold 47%, Strong Buy 28%, Buy 16% , Sell 6%, Underperform 3%

AMGN had unusually high volume on 3/21 and seemed to find a local bottom at about $270. If it can hold above its 10DMA $282, I’m leaning back to . Only bearish thing is the 50DMA is about to fall below the 200DMA which is notorious for a death cross, so I’d be watching carefully for a make or break this next two weeks for the stock.

Rhythm Pharmaceuticals

Ticker: RYTM

Cash on hand: $320M

Market Cap: $4B

Shares Outstanding: 63M

Weight Loss Drug Phase: Phase 3 Complete

Analyst Rating: Strong Buy 70%, Buy 30%

RYTM out of all the biotech stocks has the most bullish activity the last few weeks forming a bullflag on the daily chart since the beginning of April. It already completed its 10DMA crossover on 4/14, so the recent move is working perfectly with fresh all-time highs which is very bullish. Watch for $64 to become support and see $70s.

Pfizer

Ticker: PFE

Cash on hand: $20B

Market Cap: $131B

Shares Outstanding: 5B

Weight Loss Drug Phase: Phase 2-3

Analyst Rating: Hold 61%, Strong Buy 26%, Buy 9%, Sell 4%

I actually do not like to trade PFE stock, only because there is so many shares outstanding it can feel a bit sluggish for a momentum junky like myself. But, looking at this daily chart, there is that unusually high green vol bar on 3/21 that has my interest piqued. It has been trading above its 10DMA the last 5 sessions which is bullish, and now needs that confirmation back above the 50DMA aka about $25.

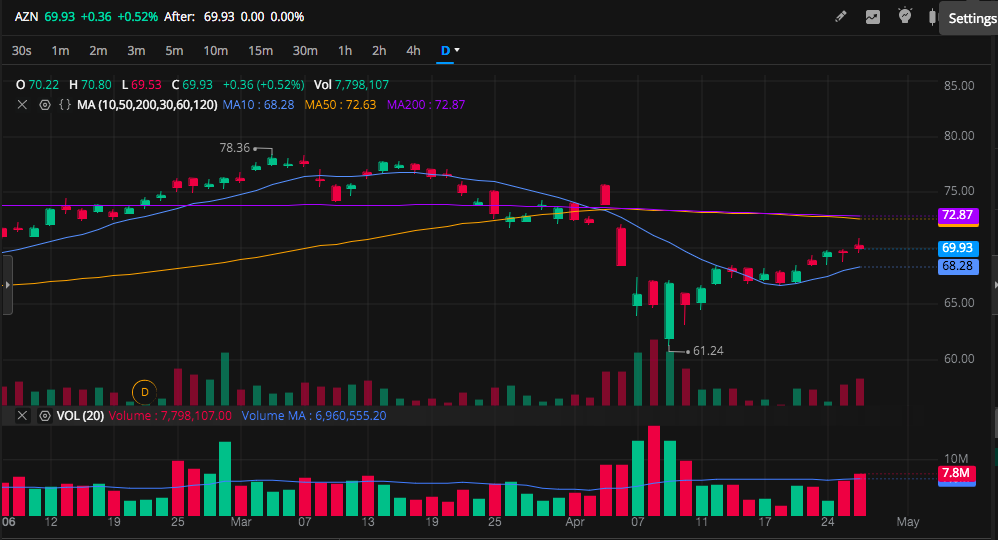

Astrazeneca

Ticker: AZN

Cash on hand: $4B

Market Cap: $219B

Shares Outstanding: 3B

Weight Loss Drug Phase: Phase 2-2B

Analyst Rating: Strong Buy 50%, Buy 42%, Hold 8%

AZN is 50/50 for me as it’s held the 10DMA strong however the potential death cross and bearish volume the last 2 sessions compared to the other stocks has me leaning for a move below the 10DMA. I could be wrong but bulls would need a solid move above $70 and a close above $72 respectively in the next 2 weeks for me to get excited.

Roche Holdings

Ticker: RHHBY

Cash on hand: $19B

Market Cap: $384M

Shares Outstanding: 77M

Weight Loss Drug Phase: Phase 2-3

Analyst Rating: Hold 57%, Strong Buy 29%, Sell 14%

RHHBY although technically OTC, this chart has me very bullish for a number of reasons: bullish volume the last 10 sessions, steady bullish trend since the $34 bottom, a potential 10DMA crossover in the works, and a solid close above the 10DMA the last 10 sessions. I would not be surprised to see this trading back above $43 in the coming weeks.